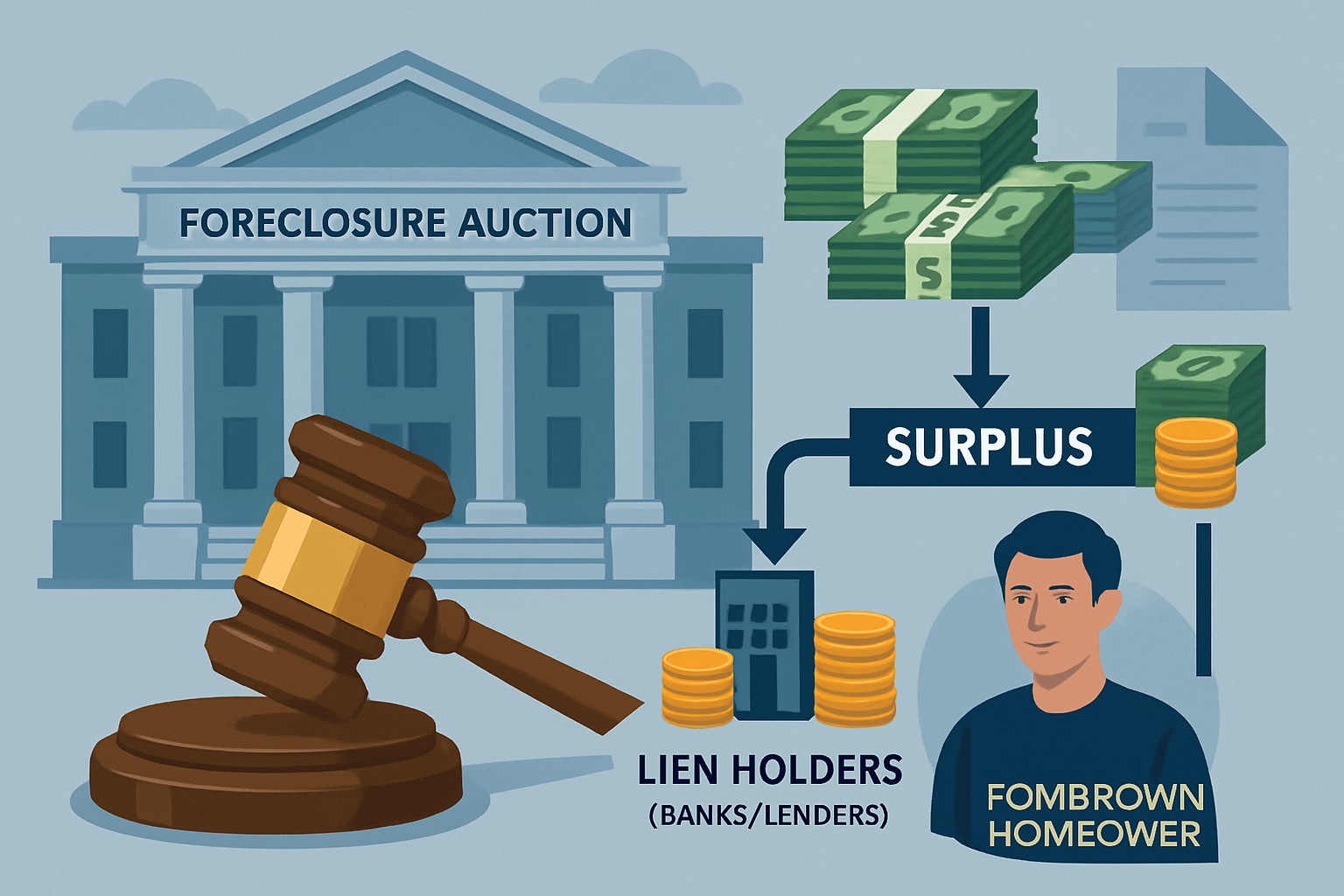

Understanding Foreclosure Auctions: How Lien Holders Only Recover What They're Owed While Surplus Belongs to the Defaulted Owner

*By Michael Duggan*

*Published: June 4, 2025*

Introduction

Foreclosure auctions represent one of the most misunderstood aspects of real estate law, particularly regarding the distribution of sale proceeds. A common misconception persists that lenders and lien holders can claim all proceeds from a foreclosure sale, leaving former homeowners with nothing. However, the legal reality is far more nuanced and protective of homeowner rights than many realize.

The fundamental principle governing foreclosure auctions is both simple and profound: lien holders are legally entitled only to recover the specific amounts they are owed, plus legitimate foreclosure costs. Any surplus funds generated when a property sells for more than the total debt obligations must be returned to the former property owner. This principle, enshrined in federal law and reinforced by state statutes across the nation, serves as a crucial protection for homeowners who have built equity in their properties over time.

Understanding this process is essential for anyone facing foreclosure, as well as for real estate professionals, investors, and legal practitioners who work within this complex system. The stakes are often substantial—surplus funds can range from thousands to hundreds of thousands of dollars, representing the accumulated equity that homeowners have built through mortgage payments, property improvements, and market appreciation over the years.

This comprehensive examination will explore the legal framework governing foreclosure surplus funds, the step-by-step process of how these funds are calculated and distributed, the rights and responsibilities of all parties involved, and the practical steps former homeowners must take to claim what is rightfully theirs. We will also address common challenges, potential pitfalls, and the unfortunate reality of unclaimed surplus funds that revert to state coffers when rightful owners fail to assert their claims within prescribed timeframes.

The Legal Foundation: Federal and State Framework for Surplus Fund Distribution

The distribution of foreclosure sale proceeds operates under a carefully structured legal hierarchy established by federal law and refined by individual state statutes. At the federal level, 12 U.S. Code § 3762 provides the foundational framework for how money realized from foreclosure sales must be distributed [1]. This federal statute establishes a clear priority system that protects the rights of former homeowners while ensuring that legitimate creditors receive what they are legally owed.

The federal law mandates that foreclosure sale proceeds be distributed in a specific order, beginning with priority payments that must be satisfied before any surplus can be distributed. These priority payments include the costs of the foreclosure proceeding itself, valid tax liens or assessments, any liens recorded before the original mortgage, the outstanding mortgage debt including principal and interest, and any late charges or fees specified in the mortgage agreement [1]. Only after these priority obligations are fully satisfied can surplus funds be distributed to other parties.

The second tier of distribution, which governs surplus funds, follows an equally clear hierarchy. First, any surplus goes to holders of liens recorded after the original mortgage, distributed according to their priority under federal or state law. Second, and most importantly for former homeowners, any remaining surplus must be paid to the appropriate mortgagor—the former property owner [1]. This legal structure ensures that lien holders cannot claim more than they are legitimately owed, regardless of how much the property sells for at auction.

State laws build upon this federal foundation, often providing additional protections and procedural requirements. For example, California law requires that surplus funds exceeding $150 trigger specific notice requirements, with the responsible party required to mail written notice to the former homeowner within 90 days of the sale [2]. Many states also establish specific timeframes within which former homeowners must claim their surplus funds, typically ranging from one to three years from the date of the foreclosure sale.

The legal principle underlying this entire framework is one of equity and fairness. As noted by legal experts, "the lender is entitled to an amount sufficient to pay off the outstanding balance of the loan plus the costs associated with the foreclosure and sale—but no more" [3]. This principle recognizes that while lenders have legitimate rights to recover their loans, they do not have the right to profit from foreclosure sales at the expense of former homeowners who have built equity in their properties.

Understanding Foreclosure Auctions: The Process and Participants

Foreclosure auctions represent the culmination of a legal process that typically begins 120 days after a homeowner stops making mortgage payments [3]. The specific procedures vary depending on whether the foreclosure is judicial (conducted through state courts) or nonjudicial (following out-of-court procedures specified by state law and the mortgage agreement). Regardless of the type, the auction process follows certain universal principles that directly impact how surplus funds are generated and distributed.

The auction itself is conducted by a trustee or court officer, such as a sheriff, and is open to the public. Both private buyers and the foreclosing lender may participate in the bidding process. The foreclosing lender typically begins the bidding with what is known as a "credit bid," which allows them to bid the amount of the outstanding mortgage debt without using actual cash [4]. This credit bidding mechanism serves as a floor for the auction, ensuring that the lender can recover at least a portion of the debt even if no outside bidders participate.

The dynamics of foreclosure auctions can vary significantly based on local market conditions, the property's condition and location, and the level of investor interest. In hot real estate markets, competitive bidding among investors and other buyers can drive sale prices well above the outstanding mortgage debt, creating substantial surplus funds. Conversely, in depressed markets or for properties in poor condition, the foreclosing lender's credit bid may be the only bid, resulting in no surplus funds.

Understanding the auction process is crucial for former homeowners because it directly impacts their potential recovery of surplus funds. Properties that sell for amounts exceeding the total debt obligations create surplus funds that must be distributed according to the legal hierarchy discussed earlier. The amount of surplus depends on several factors: the final sale price, the outstanding mortgage balance, foreclosure costs, and any junior liens or other claims against the property.

The role of the foreclosure trustee or court officer extends beyond conducting the auction to include managing any surplus funds that result from the sale. These officials are responsible for calculating the exact amount of surplus, identifying all parties with potential claims to the funds, and ensuring proper distribution according to legal requirements. They must also provide notice to former homeowners about the existence of surplus funds and the procedures for claiming them.

Calculating Surplus Funds: A Step-by-Step Breakdown

The calculation of surplus funds from a foreclosure sale follows a precise mathematical process that reflects the legal priorities established by federal and state law. Understanding this calculation is essential for former homeowners who want to determine whether they may be entitled to surplus funds and, if so, how much they might expect to receive.

The process begins with the gross sale price achieved at the foreclosure auction. From this amount, deductions are made in the specific order mandated by law. The first deduction covers the costs of the foreclosure proceeding itself, which can include legal fees, court costs, publication expenses for required notices, and the fees charged by the trustee or court officer conducting the sale [1]. These costs can vary significantly depending on the complexity of the case and local fee structures, but they typically range from several thousand to tens of thousands of dollars.

Next, any valid tax liens or assessments are deducted from the sale proceeds. Property taxes often take priority over mortgage liens, and unpaid taxes can accumulate substantial penalties and interest over time. The foreclosure sale proceeds must satisfy these tax obligations before any other distributions can be made [1]. This priority reflects the government's superior claim to tax revenue and ensures that public services funded by property taxes are not compromised by private debt arrangements.

The third category of deductions covers any liens that were recorded before the original mortgage. These might include mechanics' liens for unpaid construction work, judgment liens from prior legal proceedings, or other secured debts that predate the mortgage. While such prior liens are relatively uncommon, they must be satisfied before the mortgage debt itself can be addressed [1].

The largest deduction typically involves the mortgage debt itself, including the outstanding principal balance, accrued interest, and any late fees or penalties specified in the mortgage agreement. This amount is calculated as of the date of the foreclosure sale and includes all amounts that the borrower legally owes under the terms of the mortgage [1]. For properties that have been in foreclosure proceedings for extended periods, the accumulated interest and fees can be substantial.

After all these priority obligations are satisfied, any remaining proceeds constitute surplus funds. However, the distribution of these surplus funds follows its own hierarchy. Junior liens—such as second mortgages, home equity lines of credit, or judgment liens recorded after the original mortgage—have the first claim on surplus funds [4]. These junior lienholders are paid in order of their priority, typically determined by the date their liens were recorded.

Only after all junior liens are satisfied do surplus funds become available to the former homeowner. This final distribution represents the equity that the homeowner built in the property through mortgage payments, improvements, and market appreciation. For many homeowners, particularly those who owned their properties for many years or who purchased in appreciating markets, this surplus can represent a substantial sum.

Consider a practical example to illustrate this calculation process. Suppose a property sells at foreclosure auction for $450,000. The outstanding mortgage balance is $320,000, foreclosure costs total $8,000, there are no tax liens or prior liens, but there is a second mortgage with a balance of $40,000. The surplus calculation would proceed as follows: $450,000 (sale price) minus $8,000 (foreclosure costs) minus $320,000 (first mortgage) minus $40,000 (second mortgage) equals $82,000 in surplus funds available to the former homeowner.

The Rights and Responsibilities of Lien Holders

Lien holders in foreclosure proceedings have specific rights and responsibilities that are carefully defined by law and designed to balance their legitimate interests in debt recovery with the property rights of former homeowners. Understanding these rights and limitations is crucial for comprehending why surplus funds must be returned to former homeowners rather than retained by lenders or other creditors.

The primary right of a lien holder is to recover the amount legally owed under the terms of their lien or mortgage agreement. This includes the outstanding principal balance, accrued interest calculated according to the agreed-upon rate and terms, and any fees or penalties specifically authorized by the loan documents and applicable law [1]. Lien holders also have the right to recover reasonable costs associated with the foreclosure process, including legal fees, court costs, and other expenses directly related to enforcing their security interest in the property.

However, these rights are strictly limited to the amounts actually owed. Lien holders cannot claim surplus funds beyond their legitimate debt obligations, regardless of how much the property sells for at auction. This limitation reflects a fundamental principle of secured lending: the security interest exists to protect the lender's recovery of the debt, not to provide additional profit opportunities at the borrower's expense [3].

The responsibilities of lien holders are equally important and often overlooked. Primary lien holders who initiate foreclosure proceedings have a duty to conduct the foreclosure in accordance with all applicable legal requirements, including proper notice to the borrower and any junior lien holders. They must ensure that the foreclosure sale is conducted fairly and in compliance with state law requirements for public auctions.

When surplus funds are generated, lien holders have a responsibility to cooperate in the proper distribution of those funds. This includes providing accurate accounting of the amounts owed, releasing any claims to surplus funds beyond their legitimate debt obligations, and cooperating with trustees or court officers responsible for distributing surplus funds to rightful claimants.

Junior lien holders face particular challenges in foreclosure proceedings. When a senior lien holder forecloses, junior liens are typically extinguished unless the junior lien holder takes specific action to protect their interests. However, if surplus funds are available after the senior debt is satisfied, junior lien holders have the right to recover their debt obligations from those surplus funds, again limited to the amounts actually owed [4].

The concept of "credit bidding" illustrates both the rights and limitations of lien holders in foreclosure auctions. A foreclosing lender can bid up to the amount of the debt owed without providing cash, effectively using the debt as currency for the bid [4]. However, if other bidders drive the price above the debt amount, the lender cannot claim the excess. Instead, they receive satisfaction of their debt, and the surplus must be distributed according to legal priorities.

This framework ensures that foreclosure proceedings serve their intended purpose of debt recovery while protecting the property rights and accumulated equity of former homeowners. It prevents foreclosure from becoming a mechanism for unjust enrichment of lenders at the expense of borrowers who have built equity in their properties over time.

The Former Homeowner's Right to Surplus Funds

The right of former homeowners to claim surplus funds from foreclosure sales represents one of the most important but least understood protections in real estate law. This right stems from the fundamental principle that homeowners retain ownership of any equity they have built in their properties, even after foreclosure. Understanding this right and the process for exercising it can mean the difference between walking away from foreclosure with nothing and recovering substantial funds that represent years of mortgage payments and property appreciation.

The legal basis for this right is clear and well-established. Federal law specifically provides that surplus funds, after satisfaction of all legitimate debt obligations, must be paid "to the appropriate mortgagor"—the former property owner [1]. This language reflects the recognition that while foreclosure extinguishes the homeowner's title to the property, it does not extinguish their right to the equity they have built through mortgage payments, property improvements, and market appreciation.

However, this right comes with important responsibilities and limitations. Former homeowners do not automatically receive surplus funds; they must actively claim them within specified timeframes and follow prescribed procedures. The law places the burden on former homeowners to assert their claims, recognizing that they are in the best position to know their own circumstances and to take action to protect their interests [3].

The amount of surplus funds that former homeowners may be entitled to depends on several factors. The most obvious is the relationship between the foreclosure sale price and the total debt obligations on the property. Properties that sell for amounts significantly exceeding the mortgage balance and other liens are most likely to generate surplus funds. However, the presence of junior liens can substantially reduce or eliminate surplus funds available to former homeowners.

Market conditions play a crucial role in determining whether surplus funds will be available. In appreciating real estate markets, properties may sell for amounts well above their mortgage balances, particularly if homeowners purchased years earlier or made substantial down payments. Conversely, in declining markets or for properties with high loan-to-value ratios, foreclosure sales may not generate any surplus funds.

The timing of the foreclosure also affects potential surplus funds. Properties that go through foreclosure quickly after default may have lower accumulated interest and fees, leaving more equity available to generate surplus funds. Properties that remain in foreclosure proceedings for extended periods may see their equity eroded by accumulating interest, penalties, and foreclosure costs.

Former homeowners should also understand that their right to surplus funds is not affected by their decision to vacate the property before or during foreclosure proceedings. Many homeowners mistakenly believe that leaving the property means forfeiting any claim to surplus funds. In reality, the right to surplus funds is based on ownership at the time of foreclosure, not on continued occupancy of the property [3].

The practical exercise of this right requires former homeowners to stay informed about the foreclosure process and to take prompt action when surplus funds become available. This often means maintaining current contact information with the foreclosure trustee or court, monitoring the foreclosure proceedings, and being prepared to provide documentation of their ownership and identity when claiming surplus funds.

The Claims Process: How to Recover Surplus Funds

The process of claiming surplus funds from foreclosure sales involves specific procedures that vary by jurisdiction but share common elements designed to ensure that funds are distributed to rightful claimants while protecting against fraudulent claims. Understanding these procedures is essential for former homeowners who want to recover surplus funds, as failure to follow proper procedures or meet deadlines can result in the permanent loss of these funds.

The claims process typically begins with notice from the foreclosure trustee or court officer responsible for conducting the sale. Federal and state laws generally require that notice of surplus funds be sent to the former homeowner's last known address, which is usually the foreclosed property [3]. However, since most former homeowners have vacated the property by the time of sale, they may not receive this crucial notice unless they have provided updated contact information to the trustee or court.

This notice requirement highlights the importance of staying engaged with the foreclosure process even after vacating the property. Former homeowners should provide current contact information to the foreclosure trustee, monitor public records for information about the foreclosure sale, and proactively inquire about surplus funds if they believe the property may have sold for more than the debt obligations.

The notice of surplus funds typically includes specific information about the amount available, the deadline for filing claims, and the documentation required to support a claim. Common documentation requirements include proof of identity, evidence of ownership of the foreclosed property (such as a copy of the deed), and sometimes an affidavit or sworn statement regarding the claimant's right to the funds [4].

The timeframe for filing claims varies significantly by jurisdiction. Some states allow as little as 30 days from the date of notice, while others provide up to three years from the date of the foreclosure sale [2]. California, for example, generally provides three years for former homeowners to claim surplus funds, while other states may have much shorter deadlines. Missing these deadlines typically results in the funds being transferred to the state as unclaimed property, making recovery much more difficult and sometimes impossible.

The claims process often involves completing specific forms provided by the foreclosure trustee or court. These forms typically require detailed information about the claimant's identity, their relationship to the foreclosed property, and their basis for claiming the surplus funds. Accuracy and completeness are crucial, as errors or omissions can delay processing or result in denial of the claim.

In some cases, particularly where multiple parties claim rights to surplus funds or where the amount is substantial, a court hearing may be required. During such hearings, claimants must present evidence supporting their claims and may need to respond to challenges from other potential claimants. Having legal representation can be valuable in these situations, particularly given the complexity of foreclosure law and the potential for substantial recovery.

Former homeowners should be aware of potential scams related to surplus fund recovery. Fraudulent companies sometimes contact former homeowners claiming to help recover surplus funds in exchange for large fees or upfront payments. Legitimate surplus fund recovery does not require upfront fees, and former homeowners can typically handle the process themselves or with the assistance of an attorney working on a contingency basis [4].

The verification process for surplus fund claims is designed to prevent fraud while ensuring that legitimate claimants can recover their funds efficiently. Trustees and courts typically verify the identity of claimants, confirm their ownership of the foreclosed property, and ensure that no other parties have superior claims to the funds. This process can take several weeks or months, depending on the complexity of the case and the efficiency of the local system.

Once a claim is approved and any required waiting periods have expired, surplus funds are typically distributed by check or electronic transfer. The distribution process may include final verification steps and may require the claimant to provide updated contact and banking information. Former homeowners should be prepared for this process to take time and should maintain current contact information throughout the claims process.

Common Challenges and Pitfalls in Surplus Fund Recovery

The recovery of surplus funds from foreclosure sales, while legally straightforward in principle, often presents practical challenges that can prevent former homeowners from successfully claiming funds that are rightfully theirs. Understanding these challenges and potential pitfalls is crucial for anyone seeking to recover surplus funds, as preparation and awareness can significantly improve the chances of successful recovery.

One of the most significant challenges is the notice problem. While law requires that notice of surplus funds be sent to former homeowners, this notice is typically sent to the foreclosed property address [3]. Since most homeowners have vacated the property by the time of foreclosure sale, they may never receive this crucial notice. This problem is compounded by the fact that many homeowners, dealing with the stress and disruption of foreclosure, may not think to provide updated contact information to the foreclosure trustee or may not realize the importance of staying informed about the post-sale process.

The solution to this challenge requires proactive engagement with the foreclosure process. Former homeowners should provide current contact information to the foreclosure trustee as early as possible in the process and should monitor public records to track the progress of their foreclosure case. Many jurisdictions now provide online access to foreclosure records, making it easier for former homeowners to stay informed about their cases.

Another significant challenge involves the complexity of lien priority and the calculation of surplus funds. Former homeowners may not be aware of all liens against their property, particularly judgment liens or tax liens that may have been recorded without their knowledge. These liens can substantially reduce or eliminate surplus funds, and former homeowners may not discover their existence until they attempt to claim surplus funds.

To address this challenge, former homeowners should obtain a comprehensive title report or lien search before or during the foreclosure process. This will help them understand the total debt obligations against their property and provide a realistic assessment of whether surplus funds are likely to be available. Understanding the lien structure can also help former homeowners make informed decisions about whether to contest the foreclosure or pursue alternatives such as short sales.

The documentation requirements for surplus fund claims can also present challenges, particularly for homeowners who may have lost important documents during the foreclosure process. Proof of ownership, identity verification, and other required documentation may be difficult to obtain, particularly if the homeowner has moved multiple times or is dealing with other financial difficulties.

Preparation is key to overcoming documentation challenges. Former homeowners should gather and safeguard important documents early in the foreclosure process, including copies of their deed, mortgage documents, identification, and any other records that may be relevant to a surplus fund claim. If original documents are lost, replacement copies can often be obtained from county records offices, title companies, or lenders, but this process takes time and should be started as early as possible.

Timing presents another critical challenge in surplus fund recovery. The deadlines for filing claims are often strict and unforgiving, and former homeowners who miss these deadlines may lose their right to surplus funds permanently. The stress and disruption of foreclosure can make it difficult for homeowners to stay organized and meet important deadlines, particularly if they are dealing with other financial or personal challenges.

Creating a systematic approach to tracking deadlines and requirements can help overcome timing challenges. Former homeowners should maintain a calendar of important dates, set reminders for key deadlines, and consider seeking assistance from legal professionals or housing counselors who can help ensure that important deadlines are not missed.

The emotional and psychological challenges of foreclosure can also interfere with surplus fund recovery. Many former homeowners experience shame, depression, or anxiety related to their foreclosure, which can make it difficult to engage with the legal processes necessary to recover surplus funds. Some homeowners may also harbor misconceptions about their rights or may believe that they have forfeited all claims to their property and its value.

Education and support are crucial for overcoming these psychological barriers. Former homeowners should understand that foreclosure does not eliminate their right to surplus funds and that claiming these funds is not only legal but represents recovery of their own equity. Housing counselors, legal aid organizations, and other support services can provide both practical assistance and emotional support during this difficult process.

Fraudulent surplus fund recovery services represent another significant pitfall. These companies often contact former homeowners with promises to recover surplus funds in exchange for large upfront fees or substantial percentages of the recovered funds. While legitimate surplus fund recovery services exist, former homeowners should be cautious about any company that requires upfront payment or charges excessive fees for services that homeowners can often handle themselves [4].

To avoid fraud, former homeowners should verify any claims about surplus funds directly with the foreclosure trustee or court, should never pay upfront fees for surplus fund recovery services, and should be skeptical of unsolicited contacts from companies claiming to help with surplus fund recovery. Legitimate assistance is available through legal aid organizations, housing counselors, and attorneys who work on contingency fee arrangements.

State Variations and Jurisdictional Differences

While federal law provides the basic framework for foreclosure surplus fund distribution, state laws introduce significant variations that can substantially impact the rights and procedures available to former homeowners. Understanding these jurisdictional differences is crucial for anyone seeking to recover surplus funds, as the specific requirements, deadlines, and procedures can vary dramatically from state to state.

California, as one of the largest real estate markets in the country, has developed comprehensive procedures for handling foreclosure surplus funds. California law requires that when surplus funds exceed $150, the party conducting the foreclosure sale must mail written notice to the former homeowner within 90 days of the sale [2]. The state provides former homeowners with three years from the date of the foreclosure sale to claim surplus funds, which is more generous than many other jurisdictions. California also has specific procedures for depositing disputed surplus funds with the court and for resolving competing claims to surplus funds.

Texas takes a different approach, with procedures that vary depending on whether the foreclosure is conducted under a deed of trust or through judicial proceedings. Texas law generally requires that surplus funds be paid to the former homeowner upon demand, but the procedures for making such demands and the deadlines for doing so can vary by county and by the specific circumstances of the foreclosure.

Florida, another major real estate market, has its own unique procedures for handling surplus funds. Florida law requires that surplus funds be deposited with the court clerk, and former homeowners must file a motion with the court to claim the funds. This judicial oversight provides additional protection against fraudulent claims but can also make the recovery process more complex and time-consuming.

New York's approach reflects the state's preference for judicial foreclosures, with most surplus fund issues being resolved through court proceedings. The state's procedures provide substantial protection for former homeowners but can also result in longer delays in fund distribution due to the need for court approval of distributions.

Some states have adopted innovative approaches to address the problem of unclaimed surplus funds. For example, some jurisdictions have established online databases where former homeowners can search for unclaimed surplus funds, making it easier for rightful owners to discover and claim funds they may not have known existed. Other states have extended the deadlines for claiming surplus funds or have established procedures for notifying former homeowners through multiple channels.

The variation in state laws extends to the treatment of junior liens and the priority of different types of claims. While federal law provides general guidance on lien priority, state laws often include specific provisions for particular types of liens, such as homeowners association assessments, mechanics' liens, or tax liens. These variations can significantly impact the amount of surplus funds available to former homeowners.

State laws also vary in their treatment of foreclosure costs and the types of expenses that can be deducted from sale proceeds before calculating surplus funds. Some states have detailed regulations governing what costs can be charged to the foreclosure sale proceeds, while others provide more discretion to foreclosure trustees or courts. These differences can impact the amount of surplus funds available to former homeowners.

The notice requirements for surplus funds also vary significantly among states. While most states require some form of notice to former homeowners, the timing, method, and content of such notices can differ substantially. Some states require multiple forms of notice, including publication in newspapers or posting at the property, while others rely primarily on mailed notice to the last known address.

Understanding these jurisdictional differences is particularly important for former homeowners who have moved to different states since their foreclosure or who own property in states other than their primary residence. The laws of the state where the property is located will generally govern the surplus fund procedures, regardless of where the former homeowner currently lives.

For legal professionals and real estate investors, understanding state variations is crucial for providing accurate advice and for making informed decisions about foreclosure investments. The availability and procedures for surplus fund recovery can impact the economics of foreclosure investing and can affect the advice that should be provided to clients facing foreclosure.

The Role of Junior Lien Holders and Priority Claims

The presence of junior lien holders significantly complicates the distribution of foreclosure surplus funds and can substantially impact the amount available to former homeowners. Understanding how junior liens affect surplus fund distribution is crucial for all parties involved in foreclosure proceedings, as the priority and treatment of these liens can determine whether any surplus funds remain for the former homeowner.

Junior liens are debts secured by the property that were recorded after the primary mortgage. Common examples include second mortgages, home equity lines of credit (HELOCs), judgment liens from court proceedings, mechanics' liens for unpaid construction work, and homeowners association assessment liens [4]. The term "junior" refers to their subordinate position relative to the primary mortgage, not to their importance or validity as legal obligations.

When a senior lien holder forecloses, the foreclosure typically extinguishes junior liens, meaning that the junior lien holders lose their security interest in the property. However, this does not eliminate the underlying debt obligations; it simply removes the lien holder's right to foreclose on the property to satisfy the debt. If surplus funds are available after the senior debt is satisfied, junior lien holders have the right to recover their debt obligations from those surplus funds, but only up to the amount actually owed [1].

The priority of junior liens is typically determined by the order in which they were recorded, following the principle of "first in time, first in right." However, certain types of liens may have special priority status under state law. For example, tax liens often have priority over all other liens, regardless of when they were recorded. Mechanics' liens may have priority dating back to the commencement of work, even if they were recorded after other liens. Understanding these priority rules is crucial for accurately calculating potential surplus funds.

The impact of junior liens on surplus fund availability can be substantial. Consider a property that sells for $400,000 at foreclosure auction, with a first mortgage balance of $250,000 and foreclosure costs of $10,000. Without junior liens, this would generate $140,000 in surplus funds for the former homeowner. However, if there is a second mortgage with a $75,000 balance and a judgment lien for $30,000, the surplus available to the former homeowner would be reduced to $35,000.

In many cases, particularly in declining real estate markets or for properties with high loan-to-value ratios, the presence of junior liens can eliminate surplus funds entirely. This is because foreclosure sale proceeds often are not sufficient to satisfy both the senior mortgage debt and all junior liens, leaving nothing for the former homeowner [4]. This reality underscores the importance of understanding the complete lien structure on a property before making assumptions about potential surplus fund recovery.

Junior lien holders face their own challenges in foreclosure proceedings. They must monitor foreclosure proceedings involving properties that secure their loans and take appropriate action to protect their interests. This may involve participating in the foreclosure proceedings, filing claims for surplus funds, or pursuing other legal remedies to recover their debt obligations.

The notification requirements for junior lien holders vary by jurisdiction, but foreclosing parties typically must provide notice to known junior lien holders. However, junior lien holders are generally responsible for monitoring public records and taking action to protect their interests. Failure to participate in foreclosure proceedings or to file timely claims for surplus funds can result in the loss of recovery opportunities.

For former homeowners, understanding the impact of junior liens is crucial for setting realistic expectations about surplus fund recovery. Homeowners who are aware of junior liens on their property can better assess whether surplus funds are likely to be available and can make informed decisions about whether to pursue surplus fund claims or to focus their efforts on other financial recovery strategies.

The treatment of junior liens also affects the strategies available to homeowners facing foreclosure. In some cases, negotiating with junior lien holders to reduce or eliminate their claims may be more beneficial than allowing the foreclosure to proceed. Junior lien holders may be willing to accept reduced payments in exchange for releasing their liens, particularly if they believe that foreclosure proceedings are unlikely to generate sufficient surplus funds to satisfy their claims.

The complexity of junior lien issues often makes professional legal assistance valuable for both former homeowners and junior lien holders. Attorneys experienced in foreclosure law can help identify all liens affecting a property, assess the priority of different claims, and develop strategies for maximizing recovery opportunities within the legal framework governing surplus fund distribution.

## Unclaimed Surplus Funds: When Money Goes to the State

One of the most unfortunate aspects of the foreclosure surplus fund system is the substantial amount of money that goes unclaimed each year, ultimately reverting to state coffers as unclaimed property. This phenomenon represents a significant loss for former homeowners who may be unaware of their rights or unable to navigate the complex claims process within the required timeframes. Understanding the unclaimed property process and its implications is crucial for both former homeowners and policymakers seeking to improve the system.

The path from surplus funds to unclaimed property typically begins when former homeowners fail to claim surplus funds within the deadlines established by state law. These deadlines vary significantly among jurisdictions, ranging from as little as 30 days to as long as three years from the date of the foreclosure sale [2]. When these deadlines expire without a claim being filed, the funds are typically transferred to the state's unclaimed property division, where they may remain indefinitely.

The reasons why surplus funds go unclaimed are varied and often reflect systemic problems with the foreclosure and notification process. The most common reason is simply lack of awareness—many former homeowners do not know that they may be entitled to surplus funds or do not understand the process for claiming them. This lack of awareness is often compounded by the emotional and financial stress of foreclosure, which can make it difficult for homeowners to focus on post-foreclosure procedures.

The notice problem discussed earlier plays a significant role in the creation of unclaimed surplus funds. When notices are sent to foreclosed properties that have been vacated, former homeowners may never receive information about available surplus funds. Even when alternative notice methods are used, such as publication in newspapers, these notices may not reach former homeowners who have moved or who are not actively monitoring legal notices.

The complexity of the claims process itself can also contribute to funds going unclaimed. Former homeowners who receive notice of surplus funds may be intimidated by the documentation requirements, legal procedures, or deadlines involved in filing claims. Without assistance from legal professionals or housing counselors, some homeowners may simply give up rather than attempt to navigate the system.

Geographic mobility can create additional challenges for surplus fund recovery. Former homeowners who have moved to different states or who have changed addresses multiple times may be difficult to locate, even when foreclosure trustees or courts make good-faith efforts to provide notice. The transient nature of many foreclosure situations can make it particularly difficult to maintain contact with former homeowners throughout the surplus fund distribution process.

The financial impact of unclaimed surplus funds is substantial. While comprehensive national statistics are not readily available, individual state reports suggest that millions of dollars in foreclosure surplus funds go unclaimed each year. In California alone, reports indicate that tens of millions of dollars in surplus funds are transferred to the state's unclaimed property division annually, representing lost opportunities for former homeowners to recover equity they built in their properties.

Some states have implemented innovative approaches to reduce the amount of unclaimed surplus funds. These include extending deadlines for filing claims, improving notice procedures, establishing online databases where former homeowners can search for available funds, and providing assistance programs to help former homeowners navigate the claims process. However, these improvements are not universal, and many jurisdictions continue to struggle with high rates of unclaimed surplus funds.

The unclaimed property process does provide some ongoing opportunity for recovery, as most states maintain unclaimed property databases where former homeowners can search for funds that may be owed to them. However, recovering funds through the unclaimed property process can be more complex and time-consuming than claiming surplus funds directly from foreclosure proceedings. Additionally, some states may impose administrative fees or other costs that reduce the amount ultimately recovered by former homeowners.

For former homeowners, the lesson is clear: proactive engagement with the foreclosure process and prompt action to claim surplus funds are essential for protecting their interests. Waiting until funds have been transferred to unclaimed property divisions significantly complicates the recovery process and may result in reduced recovery amounts due to administrative costs.

The unclaimed surplus fund problem also highlights the need for systemic improvements to the foreclosure process. Better notice procedures, longer deadlines for filing claims, improved assistance programs for former homeowners, and enhanced coordination between foreclosure trustees and unclaimed property divisions could all help reduce the amount of money that goes unclaimed each year.

Practical Strategies for Maximizing Recovery

Successfully recovering surplus funds from foreclosure sales requires strategic planning, careful attention to detail, and proactive engagement with the legal process. Former homeowners who understand the system and take appropriate action can significantly improve their chances of recovering funds that represent their accumulated equity in foreclosed properties. The following strategies, based on legal requirements and practical experience, can help maximize recovery opportunities.

The foundation of any successful surplus fund recovery strategy is early engagement with the foreclosure process. Rather than disengaging after receiving foreclosure notices, former homeowners should stay actively involved in monitoring the proceedings and maintaining communication with relevant parties. This includes providing current contact information to the foreclosure trustee or court, monitoring public records for updates on the foreclosure case, and staying informed about key dates and deadlines.

Maintaining accurate and current contact information is particularly crucial, given the notice requirements for surplus fund distribution. Former homeowners should provide updated addresses, phone numbers, and email addresses to the foreclosure trustee as soon as they become available. This simple step can prevent the common problem of missed notices that leads to unclaimed surplus funds. Additionally, former homeowners should consider designating a trusted friend, family member, or attorney to receive notices on their behalf if their own contact information is likely to change frequently.

Understanding the complete lien structure on the property is essential for setting realistic expectations and developing appropriate strategies. Former homeowners should obtain a comprehensive title report or lien search to identify all debts secured by the property, including any liens they may not be aware of. This information will help determine whether surplus funds are likely to be available and will provide a basis for calculating potential recovery amounts.

Documentation preparation should begin early in the foreclosure process, well before any surplus funds become available. Former homeowners should gather and safeguard copies of their deed, mortgage documents, identification, and any other records that may be required for surplus fund claims. If original documents have been lost, replacement copies should be obtained as soon as possible, as this process can take time and may be more difficult to accomplish under the pressure of approaching deadlines.

Monitoring the foreclosure sale and its aftermath is crucial for identifying surplus fund opportunities. Former homeowners should track the sale date, attempt to determine the sale price, and promptly inquire about surplus funds if the sale price appears to exceed the debt obligations on the property. Many jurisdictions provide online access to foreclosure sale results, making it easier for former homeowners to stay informed about their cases.

When surplus funds become available, prompt action is essential. Former homeowners should respond immediately to any notices received, should file claims as soon as possible after learning about available funds, and should provide all required documentation promptly and accurately. Delays in responding to notices or filing claims can result in missed deadlines and lost recovery opportunities.

Professional assistance can be valuable in complex cases or when substantial amounts are at stake. Attorneys experienced in foreclosure law can help navigate complex lien priority issues, can ensure that all procedural requirements are met, and can represent former homeowners in contested proceedings. Housing counselors and legal aid organizations may also provide assistance, particularly for former homeowners with limited financial resources.

Former homeowners should also be prepared for the possibility that surplus fund recovery may take time. The verification and distribution process can take weeks or months, depending on the complexity of the case and the efficiency of the local system. Maintaining patience and persistence throughout this process is important for successful recovery.

Avoiding common pitfalls can also improve recovery chances. Former homeowners should be cautious about surplus fund recovery scams, should verify any claims about available funds directly with the foreclosure trustee or court, and should never pay upfront fees for surplus fund recovery services. They should also be aware of the deadlines applicable in their jurisdiction and should take action well before these deadlines expire.

For former homeowners who have already experienced foreclosure but have not yet investigated surplus fund opportunities, it may not be too late. Many states provide extended deadlines for surplus fund claims, and some funds may still be available through unclaimed property divisions even after the initial deadlines have expired. A comprehensive search of available resources, including unclaimed property databases and direct contact with foreclosure trustees or courts, may reveal recovery opportunities that are still available.

The key to successful surplus fund recovery is understanding that these funds represent the former homeowner's own equity and that claiming them is both a legal right and a practical necessity for financial recovery after foreclosure. With proper preparation, timely action, and appropriate assistance when needed, former homeowners can significantly improve their chances of recovering funds that can provide crucial financial support during a difficult transition period.

## Conclusion: Protecting Homeowner Rights in Foreclosure

The legal framework governing foreclosure surplus funds represents a crucial protection for homeowners facing the loss of their properties. The fundamental principle that lien holders can only recover what they are legally owed, while any surplus belongs to the former property owner, serves as an important safeguard against the complete loss of accumulated equity. However, the effectiveness of this protection depends largely on former homeowners understanding their rights and taking appropriate action to exercise them.

The complexity of the foreclosure surplus fund system reflects the broader complexity of real estate law and the competing interests of various parties in foreclosure proceedings. Lenders have legitimate rights to recover their loans, junior lien holders have rights to their security interests, and governments have rights to tax revenues. However, these rights are balanced against the fundamental principle that homeowners should not lose more than necessary to satisfy legitimate debt obligations.

The practical challenges facing former homeowners in recovering surplus funds highlight the need for continued improvements to the system. Better notice procedures, longer deadlines for filing claims, improved assistance programs, and enhanced coordination among the various parties involved in foreclosure proceedings could all help ensure that more former homeowners are able to recover surplus funds that are rightfully theirs.

For former homeowners currently facing foreclosure or who have recently experienced foreclosure, the message is clear: surplus fund recovery is possible, but it requires proactive engagement with the process and prompt action when opportunities arise. Understanding the legal framework, staying informed about foreclosure proceedings, maintaining current contact information, and seeking appropriate assistance when needed can significantly improve the chances of successful recovery.

The broader implications of the foreclosure surplus fund system extend beyond individual recovery opportunities to questions of housing policy and economic justice. When substantial amounts of surplus funds go unclaimed each year, this represents not only individual losses for former homeowners but also a systemic failure to protect the property rights and accumulated wealth of families who have invested in homeownership.

As real estate markets continue to evolve and as foreclosure procedures are refined through legislative and judicial action, the protection of homeowner rights in surplus fund distribution remains an important policy priority. Ensuring that former homeowners can effectively exercise their rights to surplus funds is essential for maintaining public confidence in the foreclosure system and for protecting the accumulated wealth that homeownership represents for millions of American families.

The foreclosure surplus fund system, while imperfect, provides an important mechanism for protecting homeowner equity even in the difficult circumstances of foreclosure. By understanding this system and taking appropriate action to exercise their rights, former homeowners can recover funds that represent their years of investment in homeownership and can begin the process of financial recovery after foreclosure. The key is awareness, preparation, and prompt action when opportunities arise.

## References

[1] 12 U.S. Code § 3762 - Disposition of sale proceeds. Cornell Law School Legal Information Institute. https://www.law.cornell.edu/uscode/text/12/3762

[2] Notice of Excess Proceeds. Los Angeles County Treasurer and Tax Collector. https://ttc.lacounty.gov/notice-of-excess-proceeds/

[3] Loftsgordon, A. (2025). Can You Claim Surplus Funds From a Foreclosure? Nolo. https://www.nolo.com/legal-encyclopedia/what-happens-to-excess-proceeds-from-a-foreclosure-sale.html

[4] King, C. (2025). Claiming Foreclosure Surplus Funds: Your Guide. Upsolve. https://upsolve.org/learn/foreclosure-surplus-funds/